AMORDEGRC

Definition

Returns the depreciation for each accounting period. This function is provided for the French accounting system. If an asset is purchased in the middle of the accounting period, the prorated depreciation is taken into account. The function is similar to AMORLINC, except that a depreciation coefficient is applied in the calculation depending on the life of the assets.

Sample Usage

Syntax

AMORDEGRC(cost, date_purchased, first_period, salvage, period, rate, [basis])

IMPORTANT: Dates should be entered by using the DATE function, or as results of other formulas or functions. For example, use DATE(2008,5,23) for the 23rd day of May, 2008. Problems can occur if dates are entered as text.

The AMORDEGRC function syntax has the following arguments:

Cost Required. The cost of the asset.

Date_purchased Required. The date of the purchase of the asset.

First_period Required. The date of the end of the first period.

Salvage Required. The salvage value at the end of the life of the asset.

Period Required. The period.

Rate Required. The rate of depreciation.

Basis Optional. The year basis to be used.

Basis | Date system |

0 or omitted | 360 days (NASD method) |

1 | Actual |

3 | 365 days in a year |

4 | 360 days in a year (European method) |

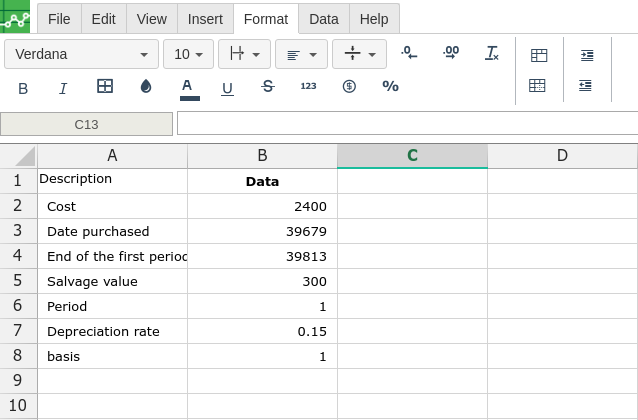

In order to use the AMORDEGRC formula, start with your edited Excellentable:

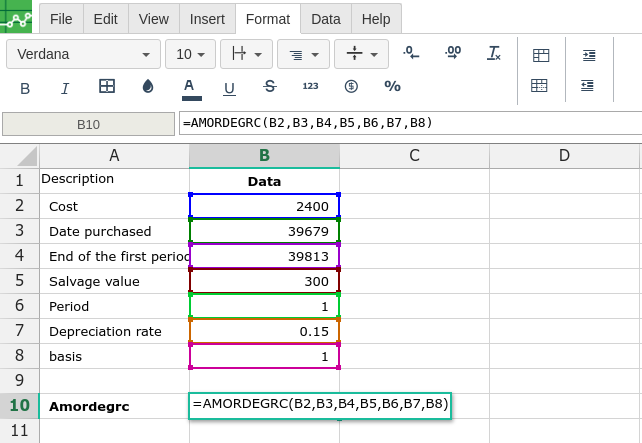

Then type in the AMORDEGRC formula in the area you would like to display the outcome:

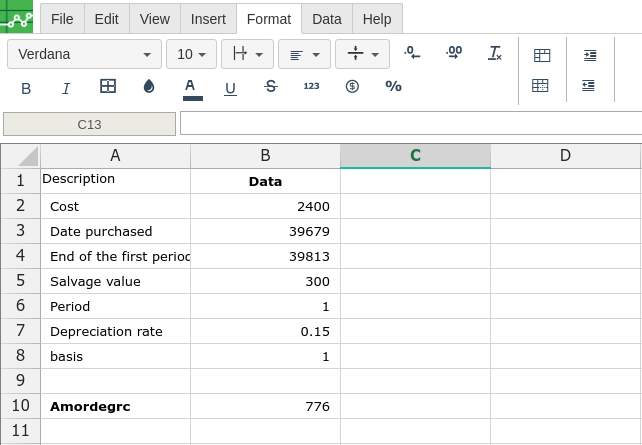

By adding the values you would like to calculate the AMORDEGRC formula for, Excellentable will generate the outcome:

A

|

B

|

|

|---|---|---|

1

|

||

2

|

||

3

|

||

4

|

||

5

|

||

6

|

||

7

|

||

8

|

||

9

|

||

10

|