DB

Definition

Calculates the depreciation of an asset for a specified period using the arithmetic declining balance method.

Sample Usage

Syntax

DB(cost, salvage, life, period, [month])

cost- The initial cost of the asset.salvage- The value of the asset at the end of depreciation.life- The number of periods over which the asset is depreciated.period- The single period withinlifefor which to calculate depreciation.month- [ OPTIONAL -12by default ] - The number of months in the first year of depreciation.

Notes

lifeandperiodmust be measured int he same units.

See Also

SYD: Calculates the depreciation of an asset for a specified period using the sum of years digits method.

SLN: Calculates the depreciation of an asset for one period using the straight-line method.

DDB: Calculates the depreciation of an asset for a specified period using the double-declining balance method.

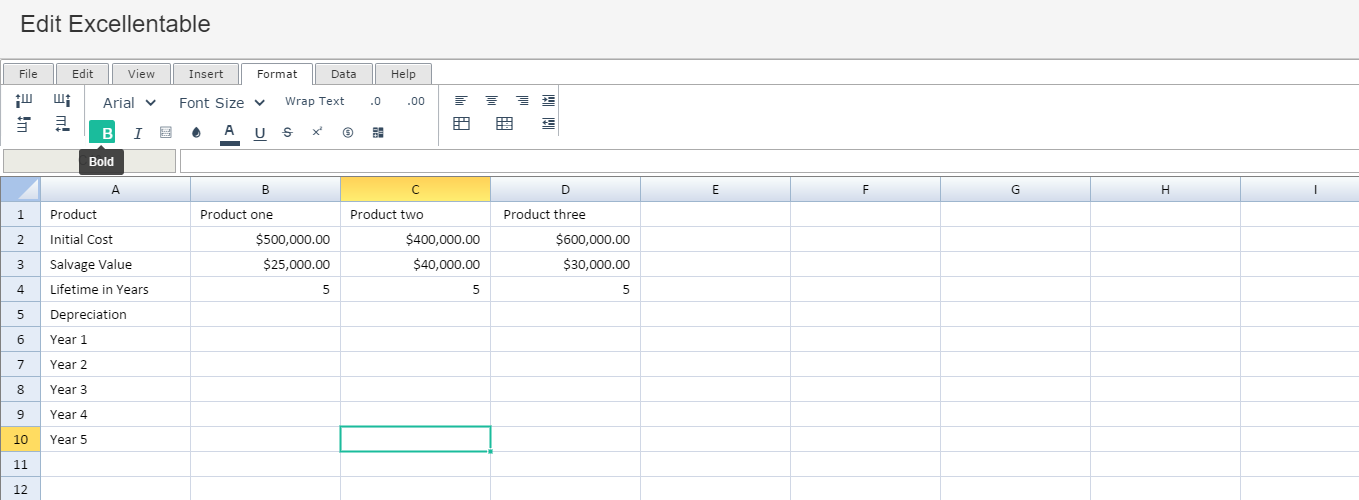

To use the DB Formula, simply begin with your edited Excellentable:

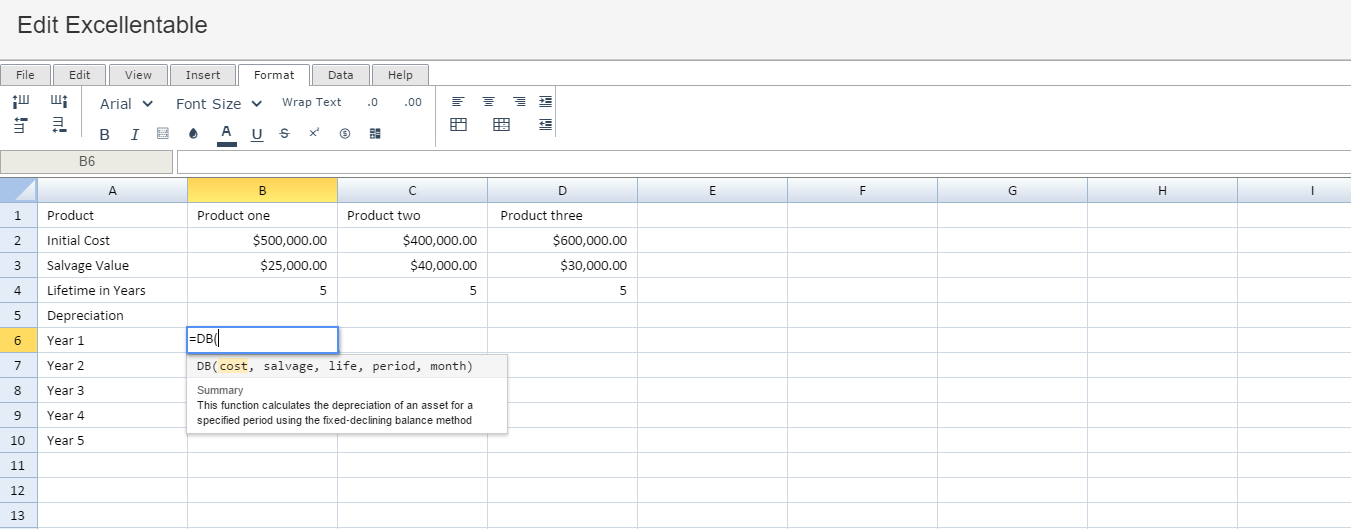

Then begin typing the DB formula in the area you would like to display the outcome:

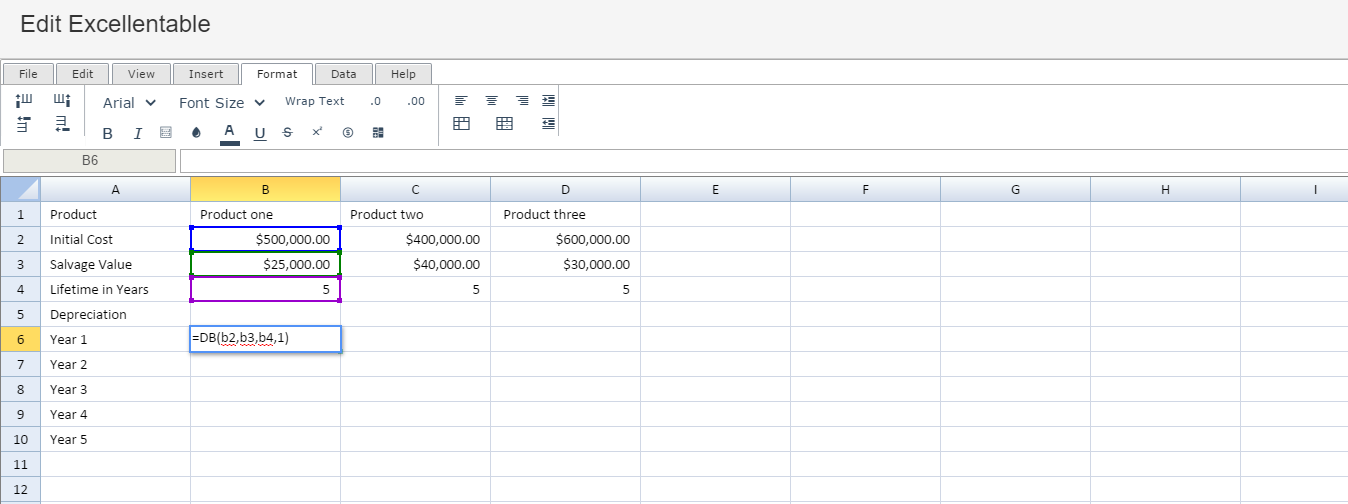

By adding the values you would like to calculate, Excellentable generates the outcome:

A

|

B

|

C

|

|

|---|---|---|---|

1

|

|||

2

|

|||

3

|

|||

4

|

|||

5

|

|||

6

|

|||

7

|

|||

8

|

|||

9

|

|||

10

|

D

|

|

|---|---|

1

|

|

2

|

|

3

|

|

4

|

|

5

|

|

6

|

|

7

|

|

8

|

|

9

|

|

10

|