DDB

Definition of DDB

Calculates the depreciation of an asset for a specified period using the double-declining balance method.

Sample Usage

DDB(100,50,10,2)

DDB(A2,A3,A4,A5,2.25)

Syntax

DDB(cost, salvage, life, period, [factor])

cost- The initial cost of the asset.salvage- The value of the asset at the end of depreciation.life- The number of periods over which the asset is depreciated.period- The single period withinlifefor which to calculate depreciation.factor- [ OPTIONAL -2by default ] - The factor by which depreciation decreases.

Notes

lifeandperiodmust be measured int he same units.While

DDBcalculates double-declining depreciation by default, use offactorallows specification of other methods.

See Also

SYD: Calculates the depreciation of an asset for a specified period using the sum of years digits method.

SLN: Calculates the depreciation of an asset for one period using the straight-line method.

DB: Calculates the depreciation of an asset for a specified period using the arithmetic declining balance method.

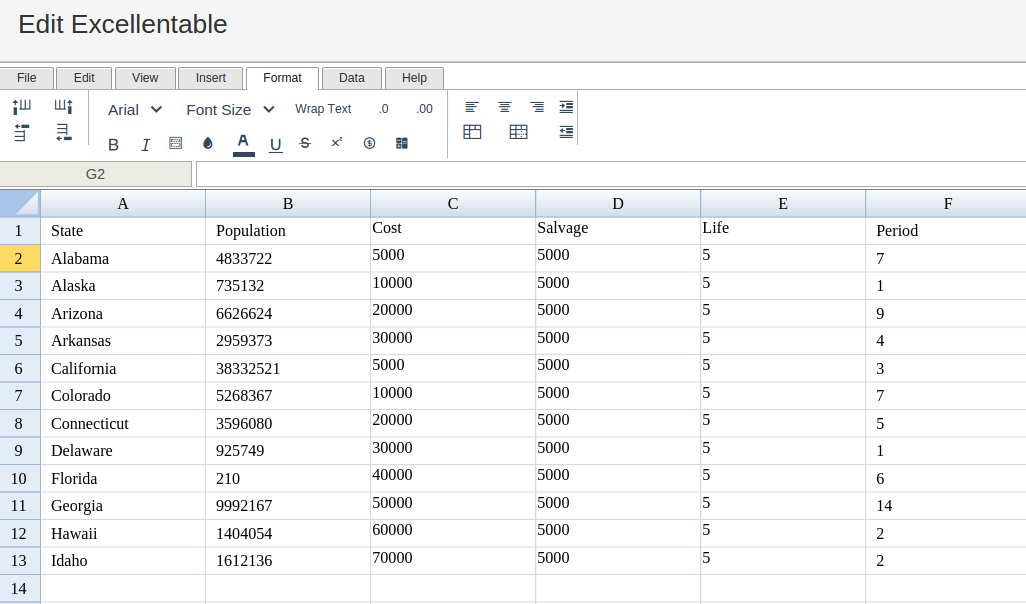

In order to use the DDB formula, start with your edited Excellentable

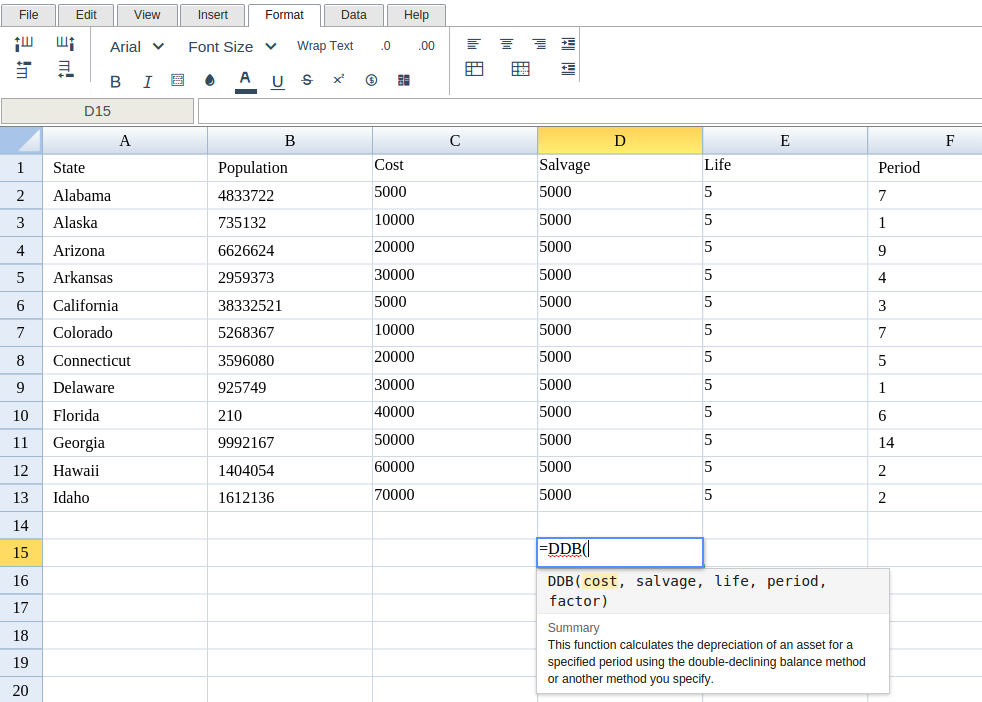

Then type in the DDB Formula in the area you would like to display the outcome:

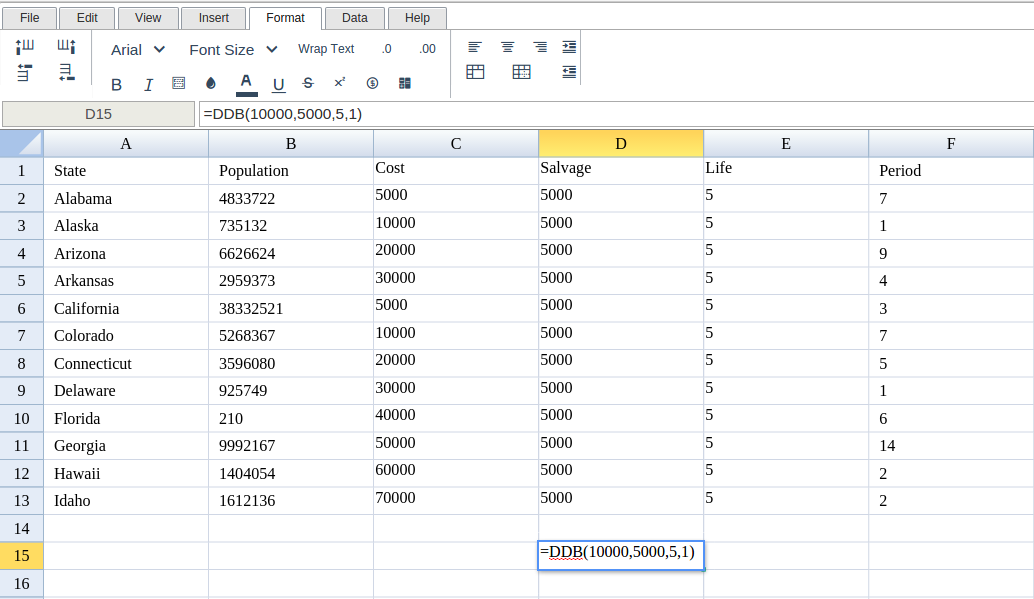

Type in the complete DDB formula for a cell as shown below:

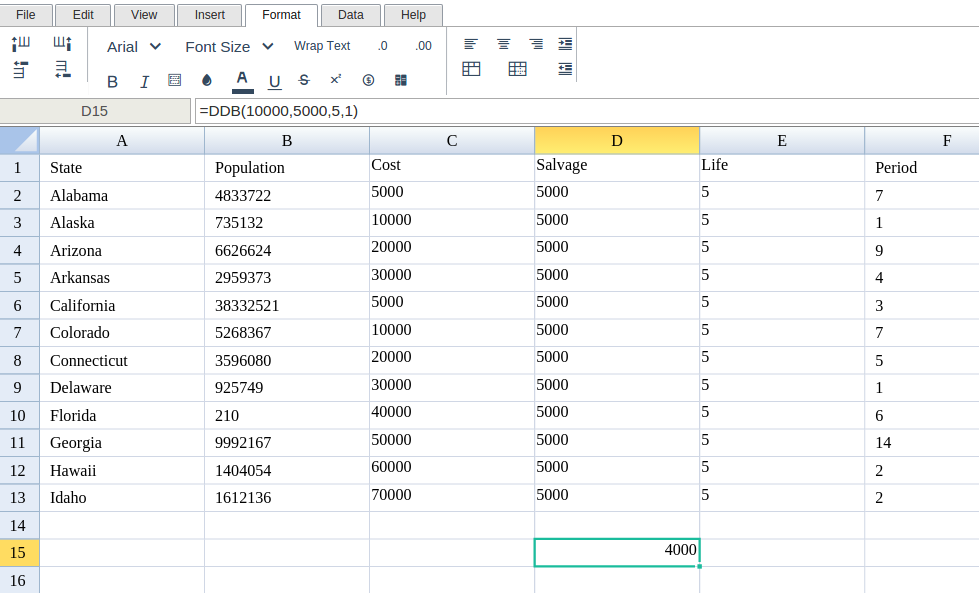

Excellentable will generate the outcome when hitting enter.

A

|

B

|

C

|

|

|---|---|---|---|

1

|

|||

2

|

|||

3

|

|||

4

|

|||

5

|

|||

6

|

|||

7

|

|||

8

|

|||

9

|

|||

10

|

|||

11

|

|||

12

|

|||

13

|

|||

14

|

|||

15

|

D

|

E

|

F

|

|

|---|---|---|---|

1

|