DURATION

Definition of DURATION

Calculates the number of compounding periods required for an investment of a specified present value appreciating at a given rate to reach a target value.

Sample Usage

DURATION(DATE(2010,01,02), DATE(2039,12,31), 3, 1.2, 2)

DURATION(A2, B2, C2, D2, E2, 1)

Syntax

DURATION(settlement, maturity, rate, yield, frequency, [day_count_convention])

settlement- The settlement date of the security, the date after issuance when the security is delivered to the buyer.maturity- The maturity or end date of the security, when it can be redeemed at face or par value.rate- The annualized rate of interest.yield- The expected annual yield of the security.frequency- The number of interest or coupon payments per year (1, 2, or 4).day_count_convention- [ OPTIONAL -0by default ] - An indicator of what day count method to use.0 indicates US (NASD) 30/360 - This assumes 30 day months and 360 day years as per the National Association of Securities Dealers standard, and performs specific adjustments to entered dates which fall at the end of months.

1 indicates Actual/Actual - This calculates based upon the actual number of days between the specified dates, and the actual number of days in the intervening years. Used for US Treasury Bonds and Bills, but also the most relevant for non-financial use.

2 indicates Actual/360 - This calculates based on the actual number of days between the specified dates, but assumes a 360 day year.

3 indicates Actual/365 - This calculates based on the actual number of days between the specified dates, but assumes a 365 day year.

4 indicates European 30/360 - Similar to

0, this calculates based on a 30 day month and 360 day year, but adjusts end-of-month dates according to European financial conventions.

Notes

settlementandmaturityshould be entered usingDATE,TO_DATE, or other date parsing functions rather than by entering text.- The Macaulay duration is different from the modified duration (

MDURATION) in that it measures the weighted average time for an investment to reach maturity. The modified duration is related to the Macaulay duration in the following way:MDURATION = DURATION / [1 + (yield / frequency)].

See Also

YIELD: Calculates the annual yield of a security paying periodic interest, such as a US Treasury Bond, based on price.

PRICE: Calculates the price of a security paying periodic interest, such as a US Treasury Bond, based on expected yield.

MDURATION: Calculates the modified Macaulay duration of a security paying periodic interest, such as a US Treasury Bond, based on expected yield.

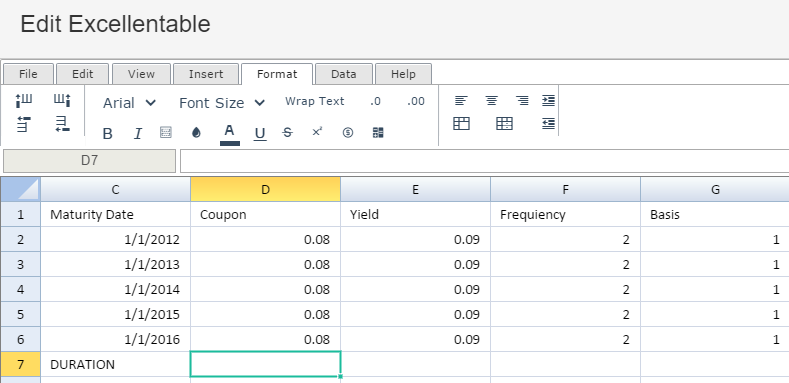

To use the DURATION Formula, simply begin with your edited Excellentable:

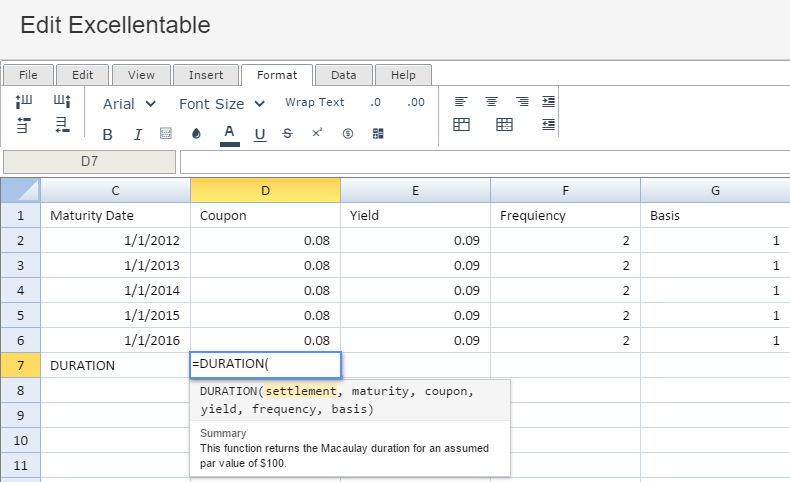

Then begin typing the DURATION formula in the area you would like to display the outcome:

.png?inst-v=2f89f79d-a349-42c3-adc2-e2dd1636fa27)

By adding the values you would like to calculate, Excellentable generates the outcome:

A

|

B

|

C

|

|

|---|---|---|---|

1

|

|||

2

|

|||

3

|

|||

4

|

|||

5

|

|||

6

|

|||

7

|

D

|

E

|

F

|

|

|---|---|---|---|

1

|

|||

2

|

|||

3

|

|||

4

|

|||

5

|

|||

6

|

|||

7

|

G

|

|

|---|---|

1

|

|

2

|

|

3

|

|

4

|

|

5

|

|

6

|

|

7

|