FVSCHEDULE

Definition of FVSCHEDULE

Calculates the future value of some principal based on a specified series of potentially varying interest rates.

Sample Usage

FVSCHEDULE(10000,A2:A100)

FVSCHEDULE(10000,{0.1,0.95,0.9,0.85})

FVSCHEDULE(A2,B2:B20)

Syntax

FVSCHEDULE(principal, rate_schedule)

principal- The amount of initial capital or value to compound against.rate_schedule- A series of interest rates to compound against theprincipal.rate_schedulemust be either a range or array containing the interest rates to compound, in sequence. These should be expressed either as decimals or as percentages usingUNARY_PERCENT, i.e.0.09orUNARY_PERCENT(9)rather than9.

See Also

PV: Calculates the present value of an annuity investment based on constant-amount periodic payments and a constant interest rate.

PPMT: Calculates the payment on the principal of an investment based on constant-amount periodic payments and a constant interest rate.

PMT: Calculates the periodic payment for an annuity investment based on constant-amount periodic payments and a constant interest rate.

NPER: Calculates the number of payment periods for an investment based on constant-amount periodic payments and a constant interest rate.

IPMT: Calculates the payment on interest for an investment based on constant-amount periodic payments and a constant interest rate.

FV: Calculates the future value of an annuity investment based on constant-amount periodic payments and a constant interest rate.

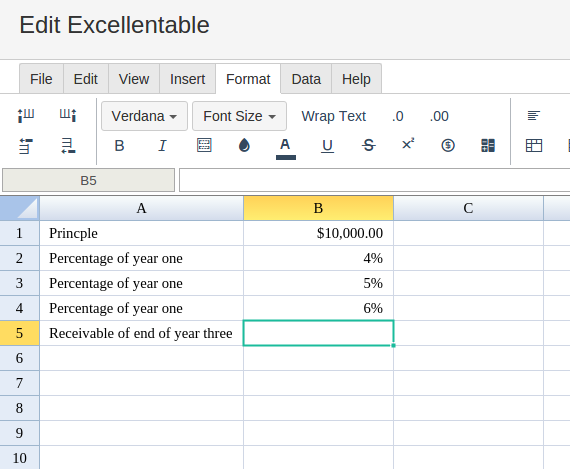

To use the FVSCHEDULE Formula, simply begin with your edited Excellentable:

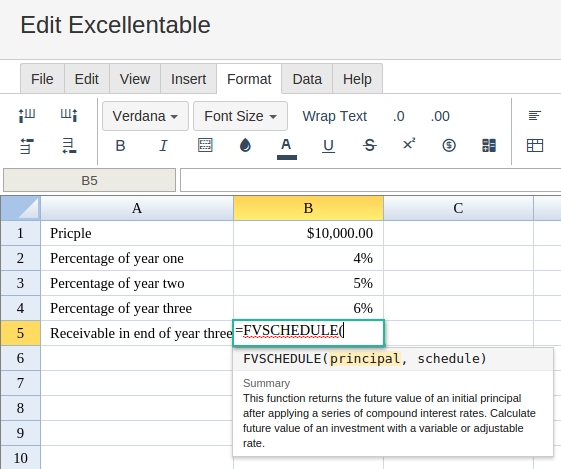

Then begin typing the FVSCHEDULE formula in the area you would like to display the outcome:

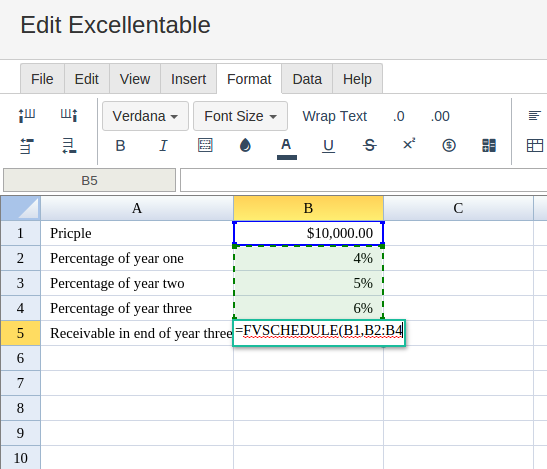

By adding the values you would like to calculate, Excellentable generates the outcome:

A

|

B

|

|

|---|---|---|

1

|

||

2

|

||

3

|

||

4

|

||

5

|