PRICEDISC

Name of Formula:

PRICEDISC

Definition/Description of Formula:

This function returns the price per $100 face value of a discounted security.

Syntax:

PRICEDISC(settlement, maturity,discount, redemption, basis)

settlement- Enter the date after issuance when the security is delivered to the buyer.maturity- The end date of the security, when it could be redeemed.- discount- The discount rate of the security at time of purchase.

redemption- The redemption value of the security.- basis- [ OPTIONAL -

0by default ] - An indicator of what day count method to use.- 0- This assumes 30 day months and 360 day years as per the National Association of Securities Dealers standard

- 1- This calculates based upon the actual number of days between the specified dates, and the actual number of days in the intervening years.

- 2- This calculates based on the actual number of days between the speficied dates, but assumes a 360 day year.

- 3- This calculates based on the actual number of days between the specified dates, but assumes a 365 day year.

- 4- Similar to

0, this calculates based on a 30 day month and 360 day year, but adjusts end-of-month dates according to European financial conventions.

Notes:

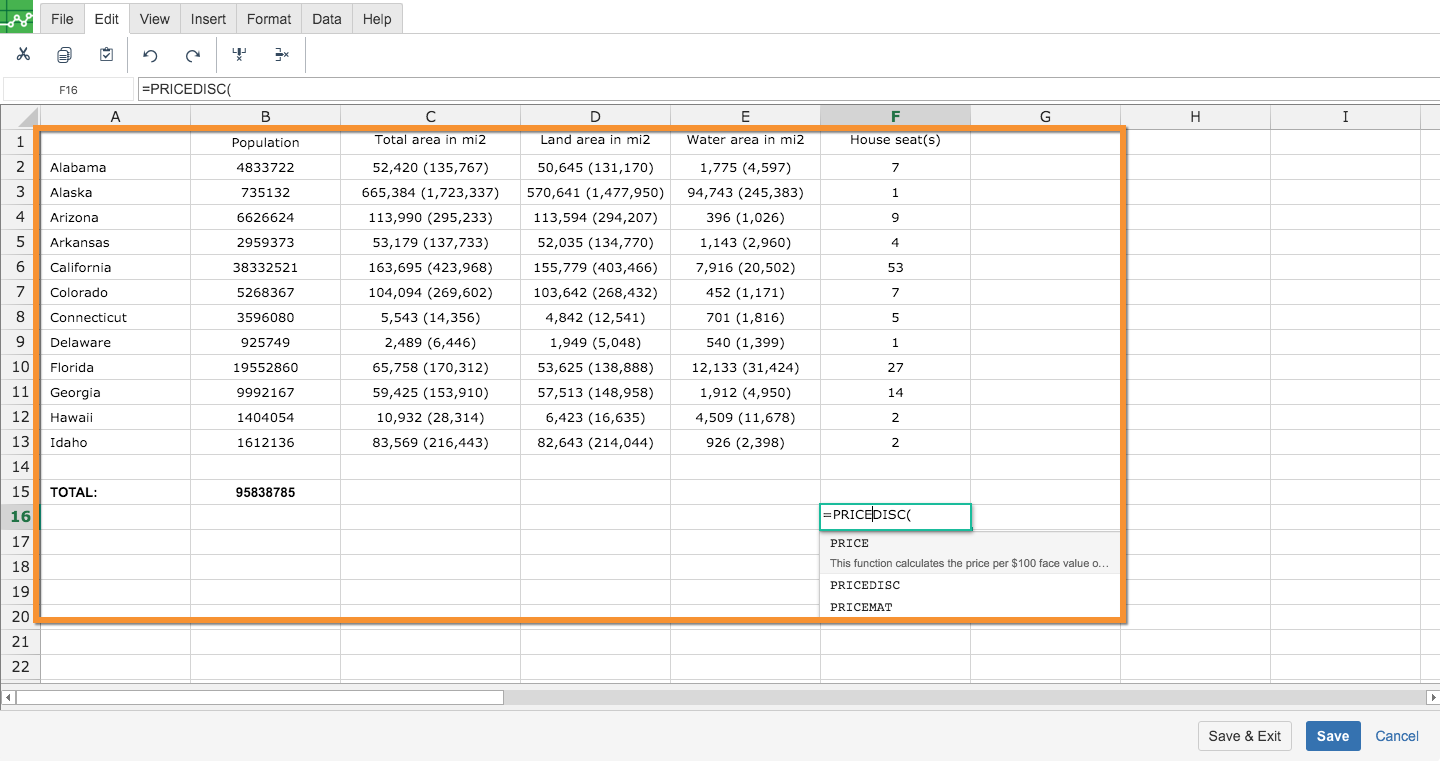

Step 1. To begin to use PRICEDISC formula, start with the Excellentable you would like to edit..

Step 2. Then type the PRICEDISC formula into the cell you have chosen to display the outcome:

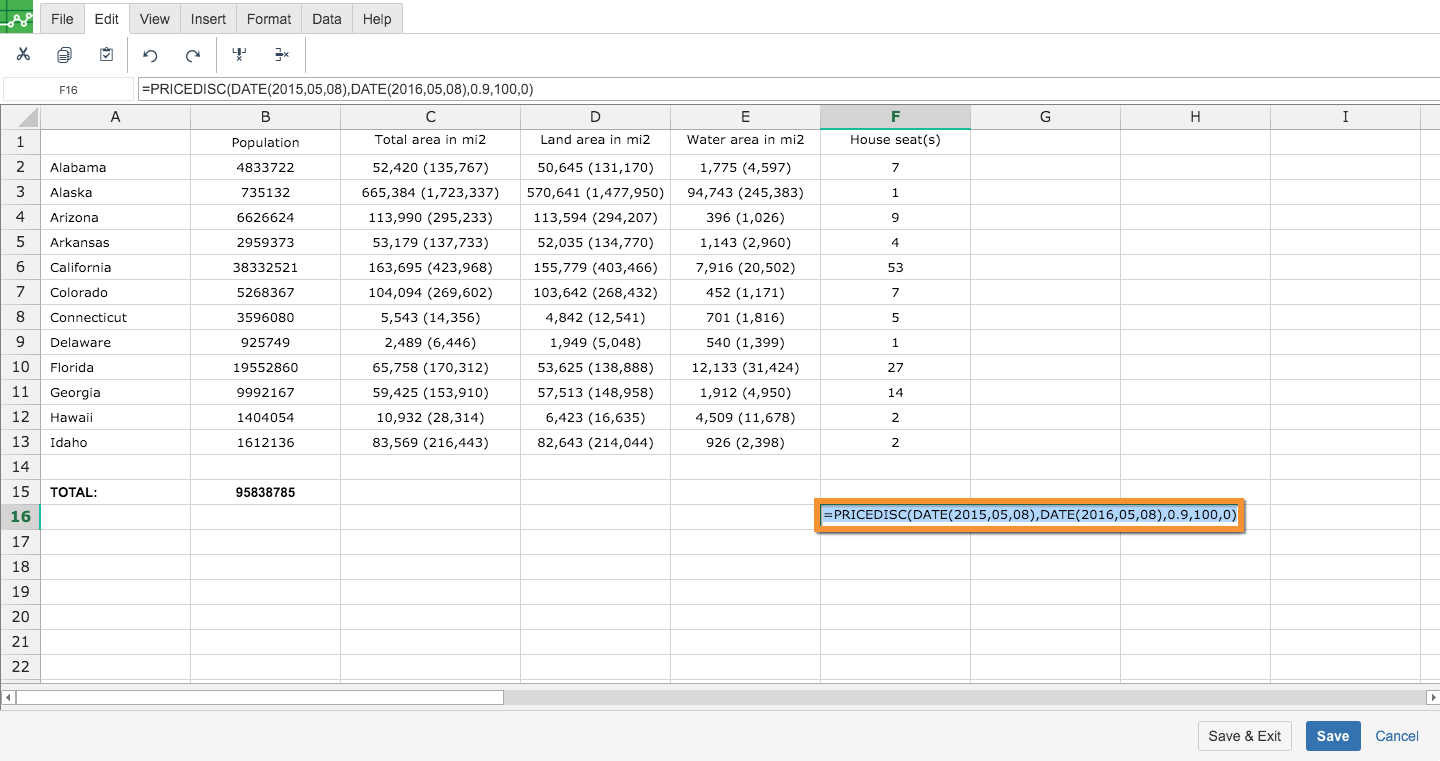

Step 3. Enter in the values needed to achieve your final outcome

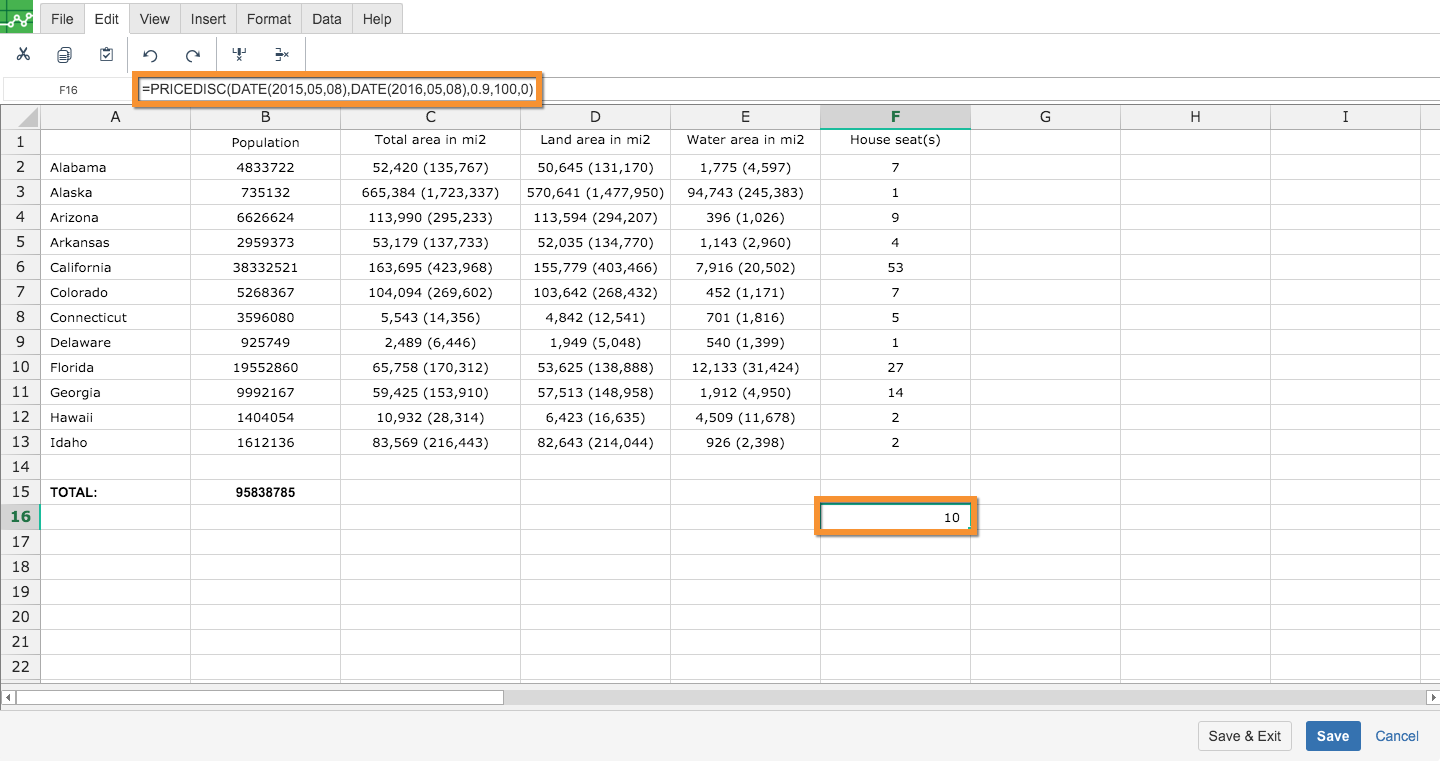

Step 4. Once saved, your completed formula will display in a confluence page like this.

A

|

B

|

C

|

D

|

|

|---|---|---|---|---|

1

|

||||

2

|

||||

3

|

||||

4

|

||||

5

|

||||

6

|

||||

7

|

||||

8

|

||||

9

|

||||

10

|

||||

11

|

||||

12

|

||||

13

|

||||

14

|

||||

15

|

||||

16

|

E

|

F

|

|

|---|---|---|

1

|

||

2

|

||

3

|

||

4

|

||

5

|

||

6

|

||

7

|

||

8

|

||

9

|

||

10

|

||

11

|

||

12

|

||

13

|

||

14

|

||

15

|

||

16

|