RATE

Definition of RATE

Calculates the interest rate of an annuity investment based on constant-amount periodic payments and the assumption of a constant interest rate.

Sample Usage

RATE(12,-100,400,0,0,0.1)

RATE(A2,B2,C2,D2,1,0.08)

Syntax

RATE(number_of_periods, payment_per_period, present_value, [future_value, end_or_beginning, rate_guess])

number_of_periods- The number of payments to be made.payment_per_period- The amount per period to be paid.present_value- The current value of the annuity.future_value- [ OPTIONAL ] - The future value remaining after the final payment has been made.end_or_beginning- [ OPTIONAL -0by default ] - Whether payments are due at the end (0) or beginning (1) of each period.rate_guess- [ OPTIONAL - 0.1 by default ] - An estimate for what the interest rate will be.

See Also

PV: Calculates the present value of an annuity investment based on constant-amount periodic payments and a constant interest rate.

PPMT: Calculates the payment on the principal of an investment based on constant-amount periodic payments and a constant interest rate.

PMT: Calculates the periodic payment for an annuity investment based on constant-amount periodic payments and a constant interest rate.

NPER: Calculates the number of payment periods for an investment based on constant-amount periodic payments and a constant interest rate.

IPMT: Calculates the payment on interest for an investment based on constant-amount periodic payments and a constant interest rate.

FVSCHEDULE: Calculates the future value of some principal based on a specified series of potentially varying interest rates.

FV: Calculates the future value of an annuity investment based on constant-amount periodic payments and a constant interest rate.

CUMPRINC: Calculates the cumulative principal paid over a range of payment periods for an investment based on constant-amount periodic payments and a constant interest rate.

CUMIPMT: Calculates the cumulative interest over a range of payment periods for an investment based on constant-amount periodic payments and a constant interest rate.

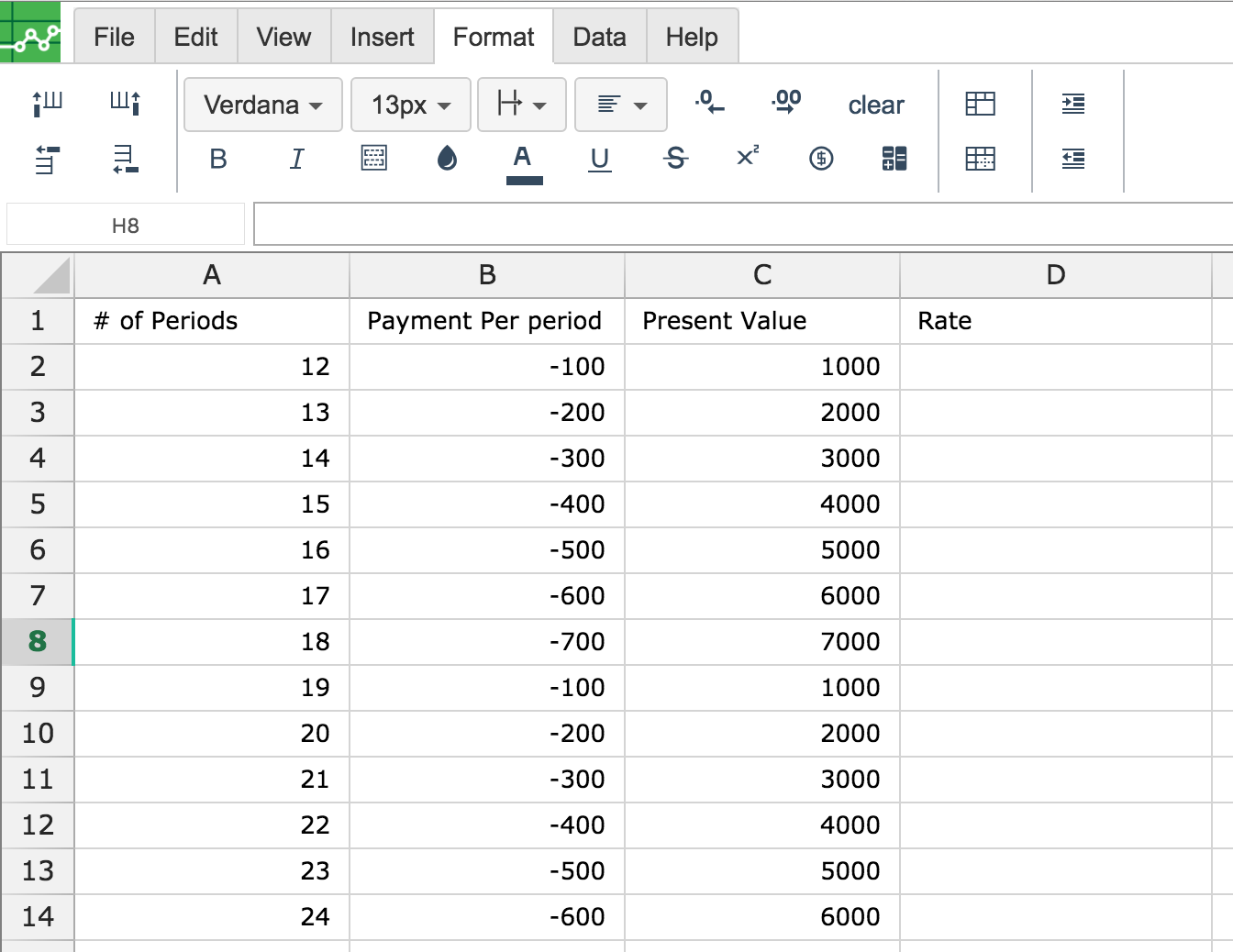

To use the RATE Formula, start with the Excellentable you would like to edit.

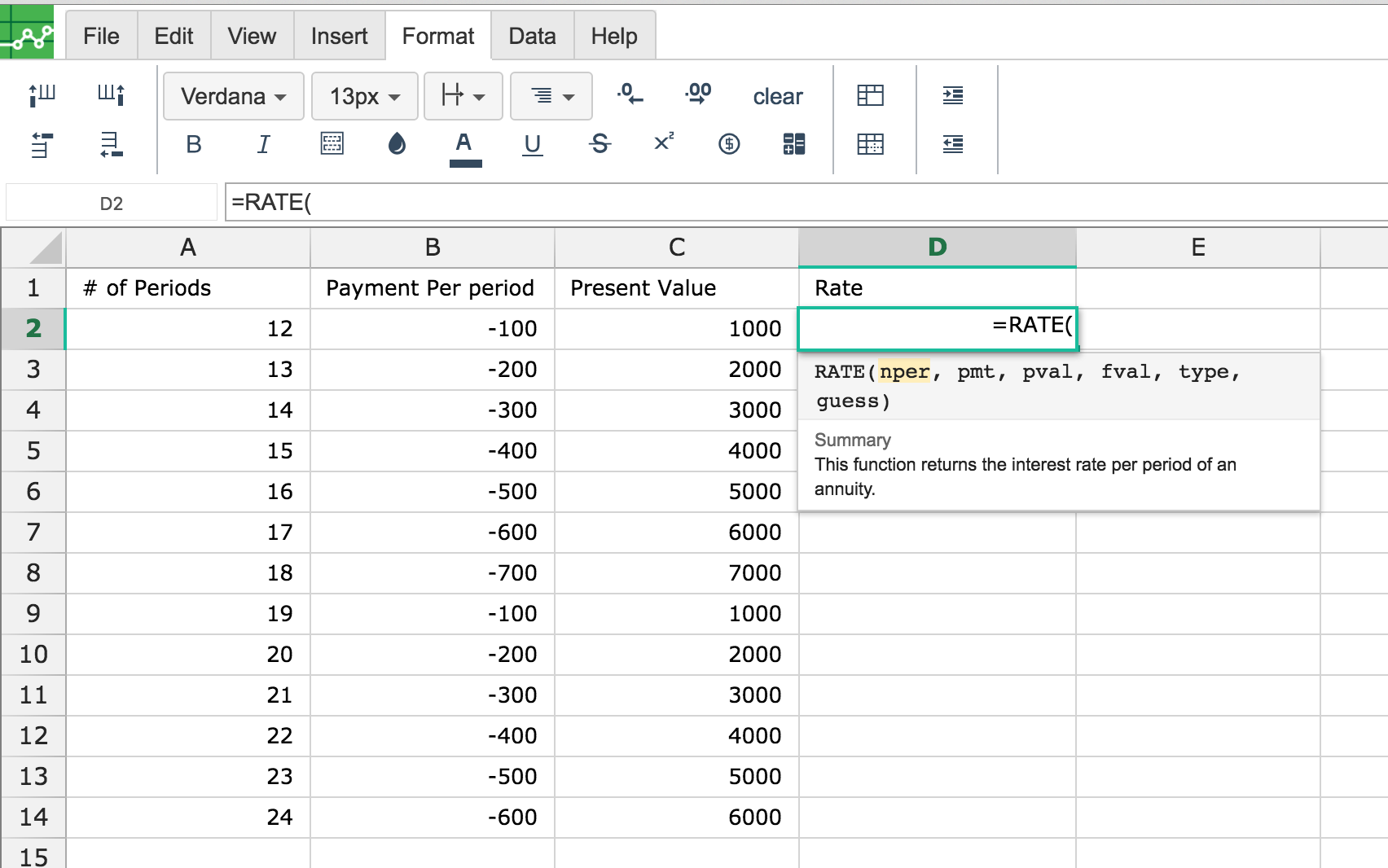

Then type the RATE formula into the cell you have chosen to display the outcome:

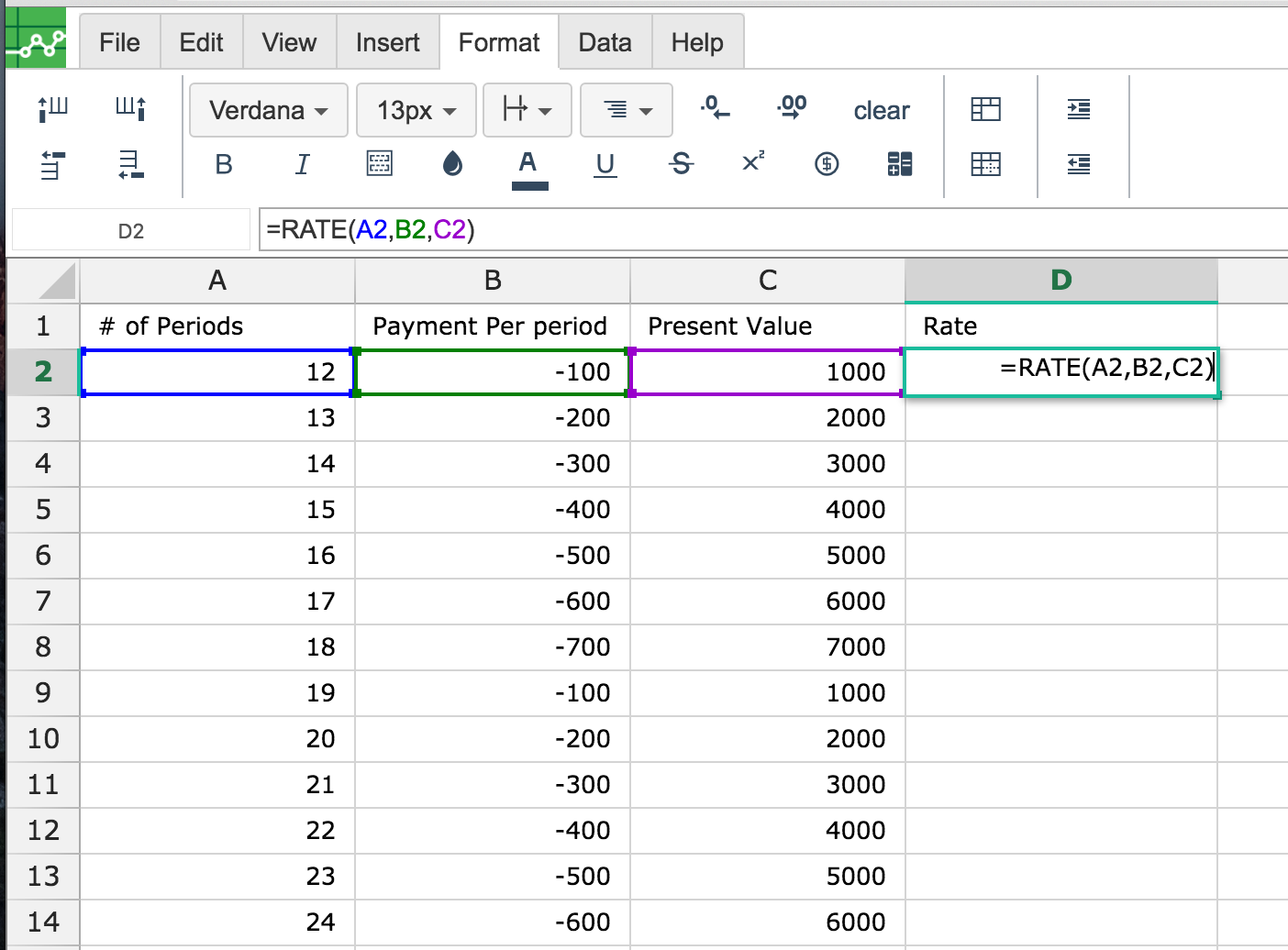

Fill in the 2 values

By adding the values you would like to calculate, Excellentable generates the outcome:

A

|

B

|

C

|

D

|

|

|---|---|---|---|---|

1

|

||||

2

|

||||

3

|

||||

4

|

||||

5

|

||||

6

|

||||

7

|

||||

8

|

||||

9

|

||||

10

|

||||

11

|

||||

12

|

||||

13

|

||||

14

|