SLN

Definition for SLN

Calculates the depreciation of an asset for one period using the straight-line method.

Sample Usage

SLN(100,50,10)

SLN(A2,A3,A4)

Syntax

SLN(cost, salvage, life)

cost- The initial cost of the asset.salvage- The value of the asset at the end of depreciation.life- The number of periods over which the asset is depreciated.

See Also

SYD: Calculates the depreciation of an asset for a specified period using the sum of years digits method.

DDB: Calculates the depreciation of an asset for a specified period using the double-declining balance method.

DB: Calculates the depreciation of an asset for a specified period using the arithmetic declining balance method.

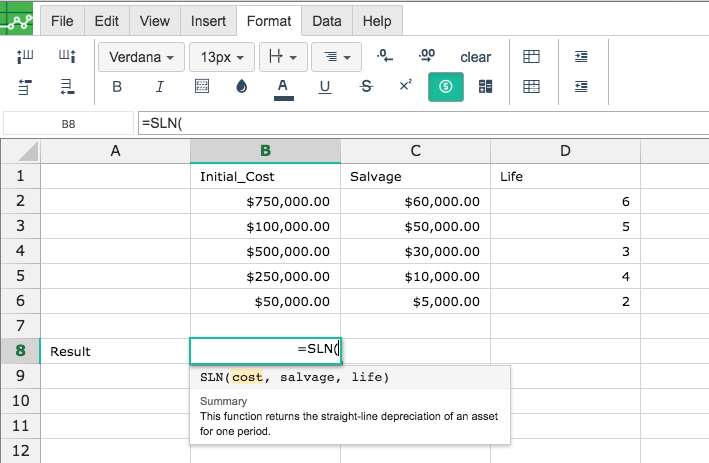

In order to use the SLN formula, start with your edited Excellentable:

Then type in the SLN Formula in the area you would like to display the outcome:

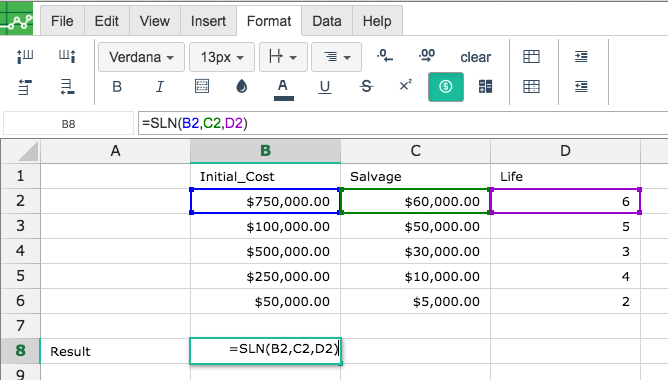

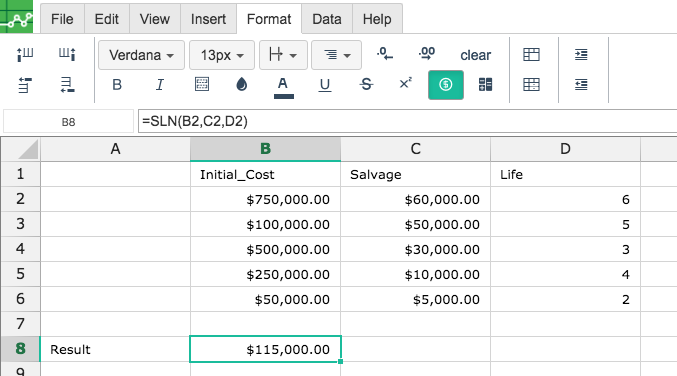

By adding the values you would like to calculate the SLN formula for, Excellentable will generate the outcome:

A

|

B

|

C

|

D

|

|

|---|---|---|---|---|

1

|

||||

2

|

||||

3

|

||||

4

|

||||

5

|

||||

6

|

||||

7

|

||||

8

|