TBILLYIELD

Definition of TBILLYIELD

Calculates the yield of a US Treasury Bill based on price.

Sample Usage

TBILLYIELD(DATE(2010,1,2), DATE(2010,12,31), 98.45)

TBILLYIELD(A2,B2,C2)

Syntax

TBILLYIELD(settlement, maturity, price)

settlement- The settlement date of the security, the date after issuance when the security is delivered to the buyer.maturity- The maturity or end date of the security, when it can be redeemed at face or par value.price- The price at which the security is bought.

Notes

settlementandmaturityshould be entered usingDATE,TO_DATEor other date parsing functions rather than by entering text.TBILLYIELDis equivalent to usingYIELDDISCwith US Treasury Bill conventions for the absent parameters.

See Also

YIELDDISC: Calculates the annual yield of a discount (non-interest-bearing) security, based on price.

YIELD: Calculates the annual yield of a security paying periodic interest, such as a US Treasury Bond, based on price.

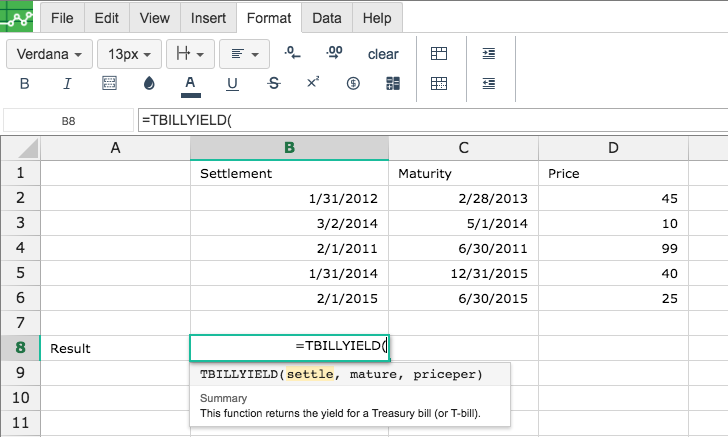

In order to use the TBILLYIELD formula, start with your edited Excellentable:

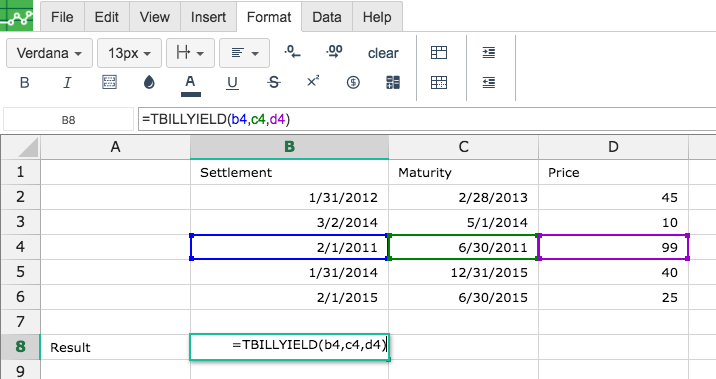

Then type in the TBILLYIELD Formula in the area you would like to display the outcome:

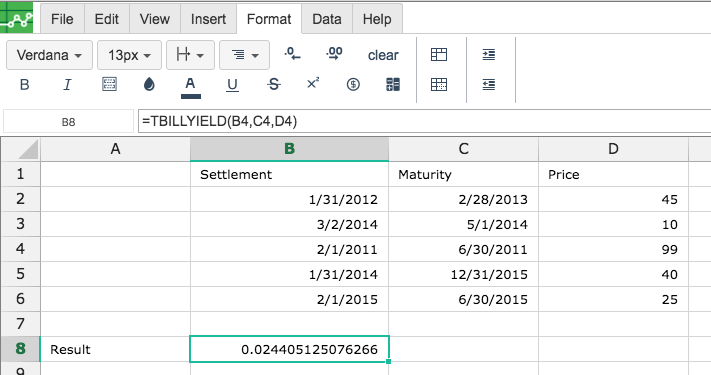

By adding the values you would like to calculate the TBILLYIELD formula for, Excellentable will generate the outcome:

A

|

B

|

C

|

D

|

|

|---|---|---|---|---|

1

|

||||

2

|

||||

3

|

||||

4

|

||||

5

|

||||

6

|

||||

7

|

||||

8

|