VDB

Description

Returns the depreciation of an asset for any period you specify, including partial periods, using the double-declining balance method or some other method you specify. VDB stands for variable declining balance.

Sample Usage

Syntax

VDB(cost, salvage, life, start_period, end_period, [factor], [no_switch])

The VDB function syntax has the following arguments:

Cost Required. The initial cost of the asset.

Salvage Required. The value at the end of the depreciation (sometimes called the salvage value of the asset). This value can be 0.

Life Required. The number of periods over which the asset is depreciated (sometimes called the useful life of the asset).

Start_period Required. The starting period for which you want to calculate the depreciation. Start_period must use the same units as life.

End_period Required. The ending period for which you want to calculate the depreciation. End_period must use the same units as life.

Factor Optional. The rate at which the balance declines. If factor is omitted, it is assumed to be 2 (the double-declining balance method). Change factor if you do not want to use the double-declining balance method. For a description of the double-declining balance method, see DDB.

No_switch Optional. A logical value specifying whether to switch to straight-line depreciation when depreciation is greater than the declining balance calculation.

If no_switch is TRUE, Microsoft Excel does not switch to straight-line depreciation even when the depreciation is greater than the declining balance calculation.

If no_switch is FALSE or omitted, Excel switches to straight-line depreciation when depreciation is greater than the declining balance calculation.

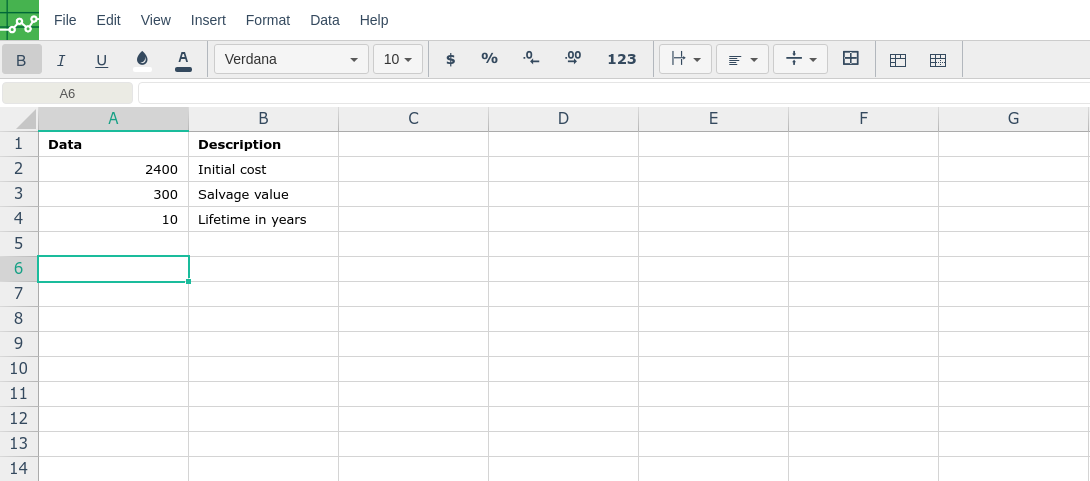

In order to use the VDB formula, start with your edited Excellentable

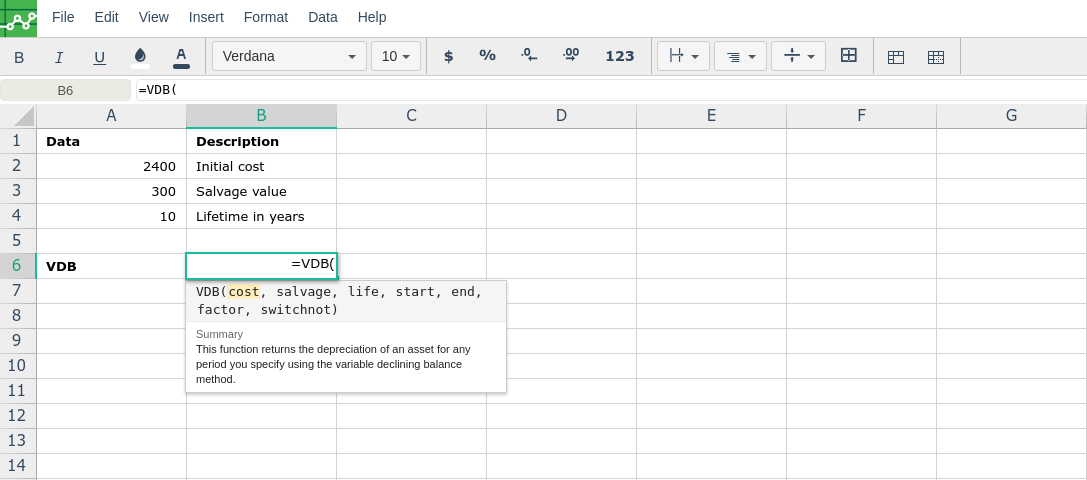

Then type in the VDB formula in the area you would like to display the outcome:

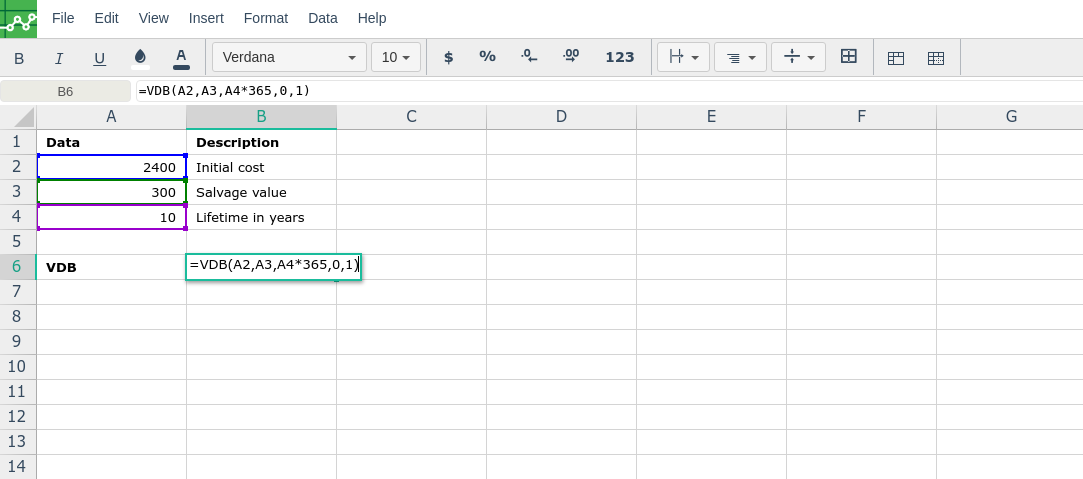

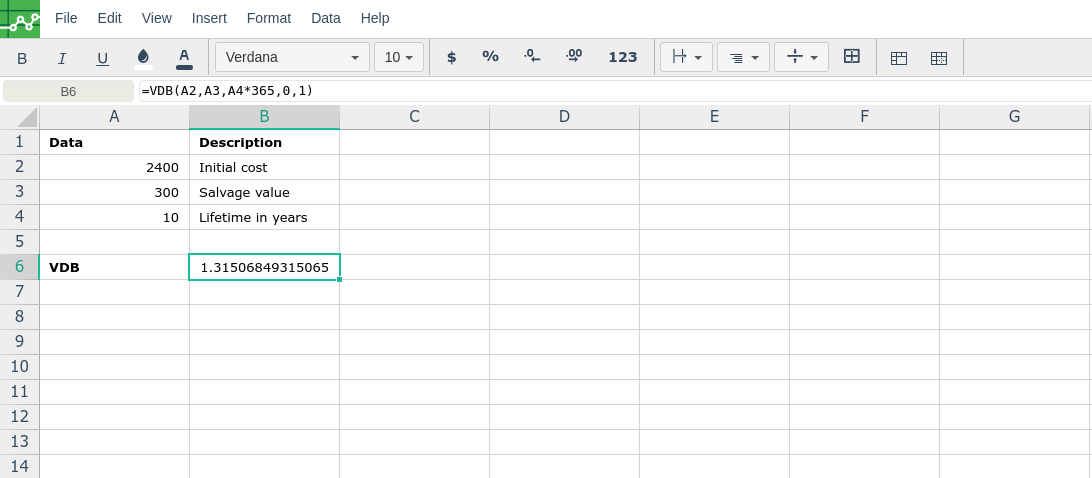

By adding the values you would like to calculate the VDB formula for, Excellentable will generate the outcome:

A

|

B

|

|

|---|---|---|

1

|

||

2

|

||

3

|

||

4

|

||

5

|

||

6

|