COUPDAYSNC

Definition/Description of COUPDAYSNC:

Calculates the number of days from the settlement date until the next coupon payment (interest payment)

Syntax:

COUPDAYSNC (settlement, maturity, frequency, basis)

- Settlement - the date of purchase of the security.

Maturity- due date (end date) of the security on which it can be redeemed for the nominal valueFrequency- number of interest payments (coupon payments) per year (1, 2 or 4)- Basis - [ optional - default is

0] - Indicates the basis on which the day count.- 0 stands for the US interest method (NASD) 30/360 - This 30-day months and years are assumed to be 360 days according to standard of the US National Association of Securities Dealers and specific adaptations to the data entered made the end of the month fall.

- 1 stands for Actual / Actual - This is calculated based on the actual number of days between the given data and the actual number of days in the intervening years. This convention is used for US Treasury notes and changing, but in particular also in the non-financial decisively.

- 2 indicates Actual / 360 - This is calculated based on the actual number of days between the dates specified, but assumed that a year has 360 days.

- 3 indicates Actual / 365 - This is calculated based on the actual number of days between the dates specified, but assumed that a year has 365 days.

- 4 represents the European interest method 30/360 - Similar to

0months adopted by 30 days and years with 360 days here, but end of month data are adjusted in accordance with the European financial conventions.

Remarks:

Settlementandmaturityto use the functionsDATE,TO_DATEbe added or other date parsing, not by text input.

See Also:

YIELDDISC : Calculates the annual yield of a discount paper based on price.

YIELD : Calculates the annual yield of a security, be paid for periodic interest, such as a US Treasury statement, based on price.

PRICEMAT : Calculates the price of a security, to be paid for the interest on the maturity date, based on the expected rate of return.

PRICEDISC : Calculates the price of discount paper based on the expected rate of return.

DURATION : Calculates the number of compounding periods, which are necessary for an investment with a given present value with a specific value growth rate to achieve a target value.

DISC : Calculates the discount of a security based on price.

COUPPCD : Calculates the last coupon or interest payment date prior to the settlement date.

COUPNUM : Calculates the number of coupon or interest payments between the settlement date and the maturity date of the investment.

COUPNCD : Calculates the next coupon or interest payment date after the settlement date.

COUPDAYS : Calculates the number of days in the coupon period (interest payment period) that contains the specified settlement date.

COUPDAYBS : Calculates the number of days from the first coupon or interest payment until settlement date.

ACCRINTM : Calculates the accrued interest of a security, to be paid for when due interest.

ACCRINT : Calculates the accrued interest for a security that pays periodic interest.

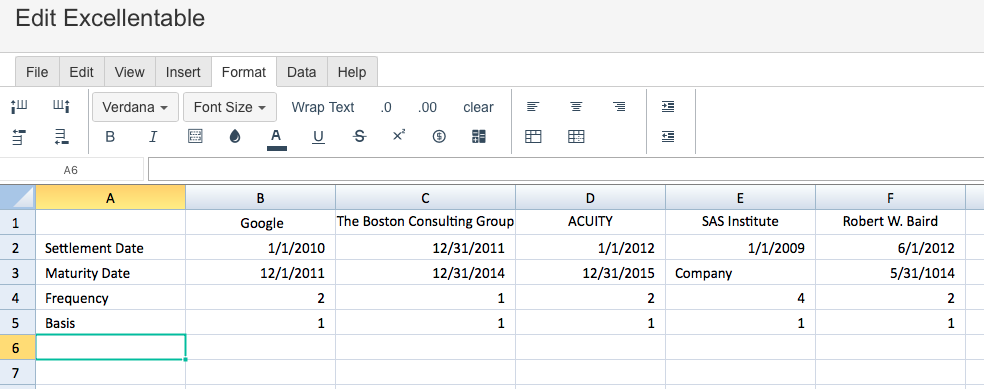

To use the COUPDAYSNC Formula, simply begin with your edited Excellentable:

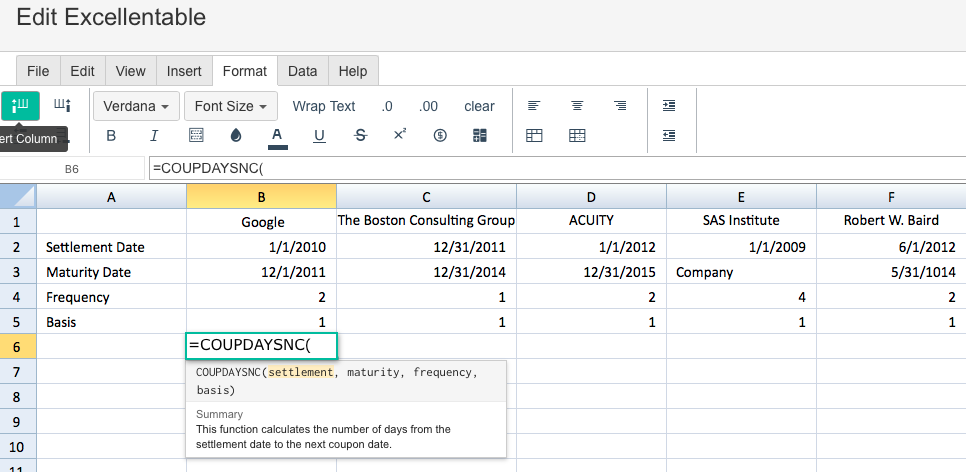

Then begin typing the COUPDAYSNC formula in the area you would like to display the outcome:

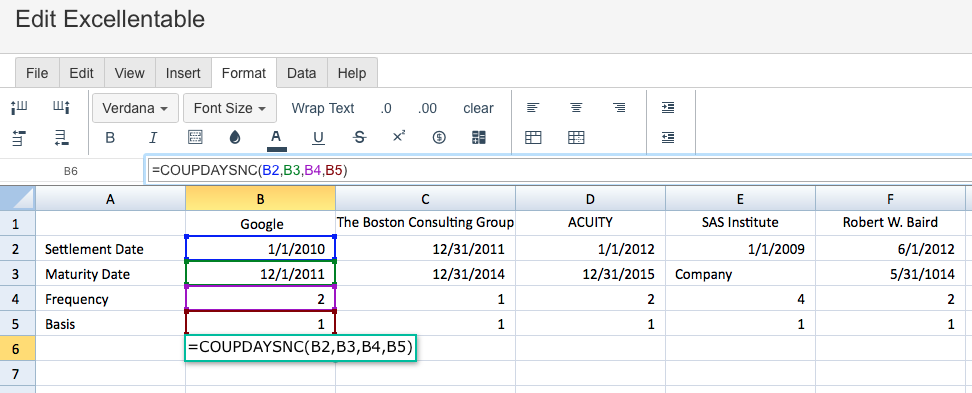

By adding the values you would like to calculate, Excellentable generates the outcome:

A

|

B

|

C

|

|

|---|---|---|---|

1

|

|||

2

|

|||

3

|

|||

4

|

|||

5

|

|||

6

|

D

|

E

|

F

|

|

|---|---|---|---|

1

|

|||

2

|

|||

3

|

|||

4

|

|||

5

|

|||

6

|