NPER

Definition of NPER:

This formula calculates the number of payment periods for an investment based on constant-amount periodic payments and a constant interest rate.

Sample Usage

NPER(2,500,40000)

NPER(A2,B2,C2,D2,1)

Syntax

NPER(rate, payment_amount, present_value, [future_value, end_or_beginning])

rate- The interest rate.

payment_amount- The amount of each payment made.

present_value- The current value of the annuity.

future_value- [ OPTIONAL ] - The future value remaining after the final payment has been made.

end_or_beginning- [ OPTIONAL -0by default ] - Whether payments are due at the end (0) or beginning (1) of each period.

Notes

- Ensure that consistent units are used for

rateandpayment_amount. For example, a car loan for 36 months may be paid monthly, in which case the annual percentage rate should be divided by 12 and thepayment_amountis the amount of each monthly payment. On the other hand, a different type of loan of the same length and principal might be paid quarterly, in which case the annual percentage rate should be divided by 4 and the amount paid each period would be adjusted accordingly..

See Also

PV: Calculates the present value of an annuity investment based on constant-amount periodic payments and a constant interest rate.

PPMT: Calculates the payment on the principal of an investment based on constant-amount periodic payments and a constant interest rate.

PMT: Calculates the periodic payment for an annuity investment based on constant-amount periodic payments and a constant interest rate.

IPMT: Calculates the payment on interest for an investment based on constant-amount periodic payments and a constant interest rate.

FVSCHEDULE: Calculates the future value of some principal based on a specified series of potentially varying interest rates.

FV: Calculates the future value of an annuity investment based on constant-amount periodic payments and a constant interest rate.

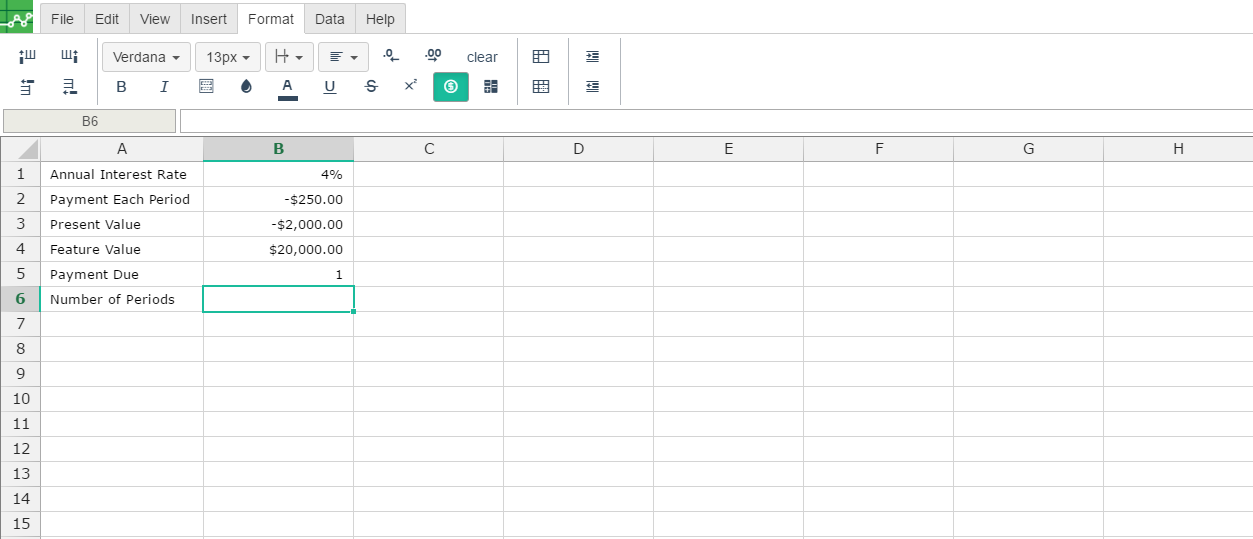

Step 1. To use the NPER Formula, start with the Excellentable you would like to edit.

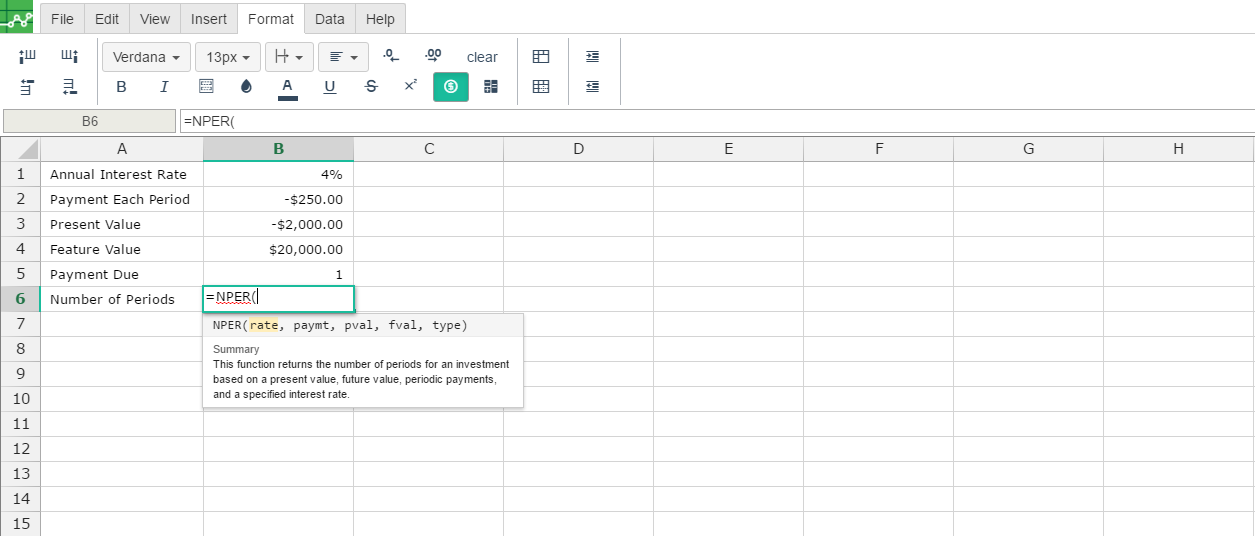

Step 2. Then type the NPER formula into the cell you have chosen to display the outcome:

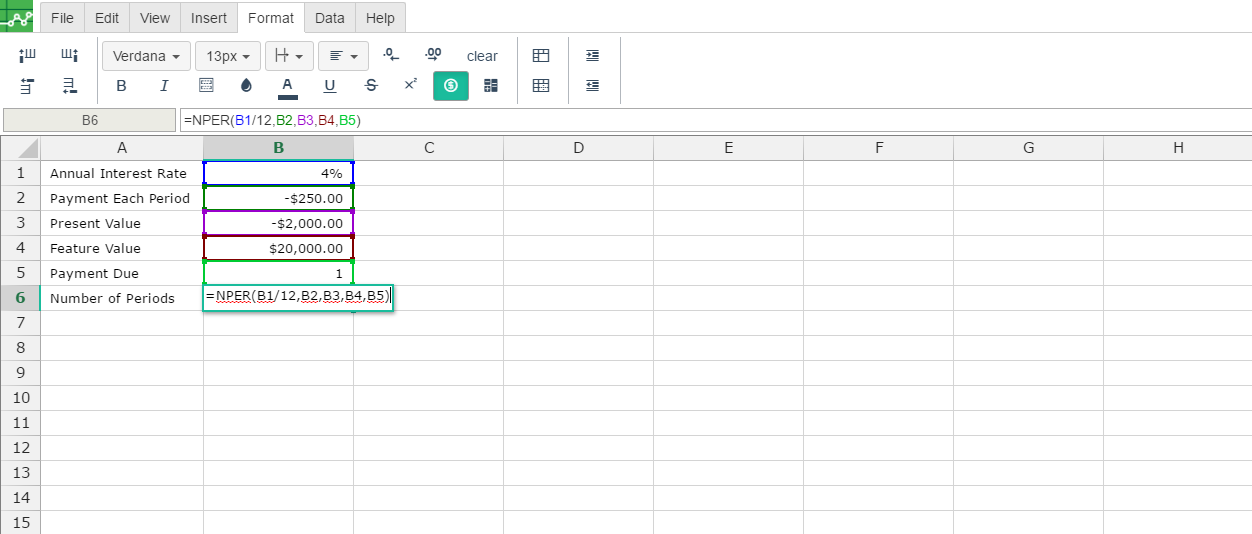

Step 3. Fill in the 5 values- In this example I have chosen 5 values that are the same.

By adding the values you would like to calculate, Excellentable generates the outcome:

A

|

B

|

|

|---|---|---|

1

|

||

2

|

||

3

|

||

4

|

||

5

|

||

6

|