NPV

Definition of NPV:

This formula calculates the net present value of an investment based on a series of periodic cash flows and a discount rate.

Sample Usage

NPV(0.08,200,250,300)

NPV(A2,A3,A4,A5)

Syntax

NPV(discount, cashflow1, [cashflow2, ...])

discount- The discount rate of the investment over one period.

cashflow1- The first future cash flow.

cashflow2, ...- [ OPTIONAL ] - Additional future cash flows.

Notes

- Each

cashflowargument should be positive if it represents income from the perspective of the owner of the investment (e.g. coupons) or negative if it represents payments (e.g. loan repayment).

- Each

cashflowargument may be either a value, a reference to a value, or a range containing values. Cashflows are considered in the order they are referenced.

IRRunder the same conditions calculates the internal rate of return for which the net present value is zero.

- If the cash flows of an investment are irregularly spaced, use

XNPVinstead.

See Also

XNPV: Calculates the net present value of an investment based on a specified series of potentially irregularly spaced cash flows and a discount rate.

XIRR: Calculates the internal rate of return of an investment based on a specified series of potentially irregularly spaced cash flows.

PV: Calculates the present value of an annuity investment based on constant-amount periodic payments and a constant interest rate.

MIRR: Calculates the modified internal rate of return on an investment based on a series of periodic cash flows and the difference between the interest rate paid on financing versus the return received on reinvested income.

IRR: Calculates the internal rate of return on an investment based on a series of periodic cash flows.

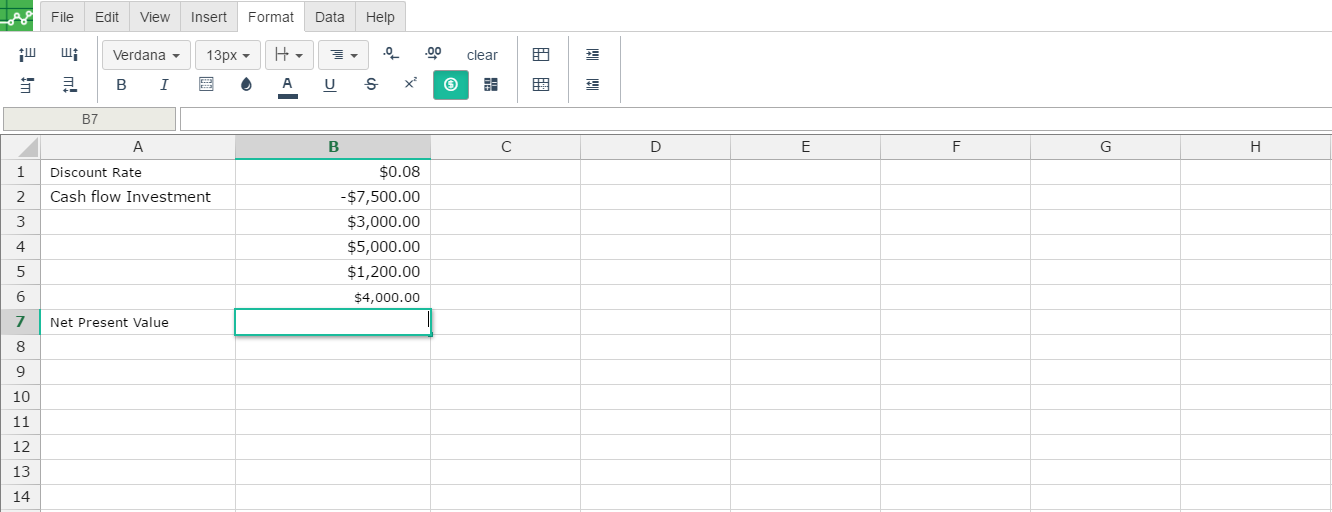

Step 1. To use the NPV Formula, start with the Excellentable you would like to edit.

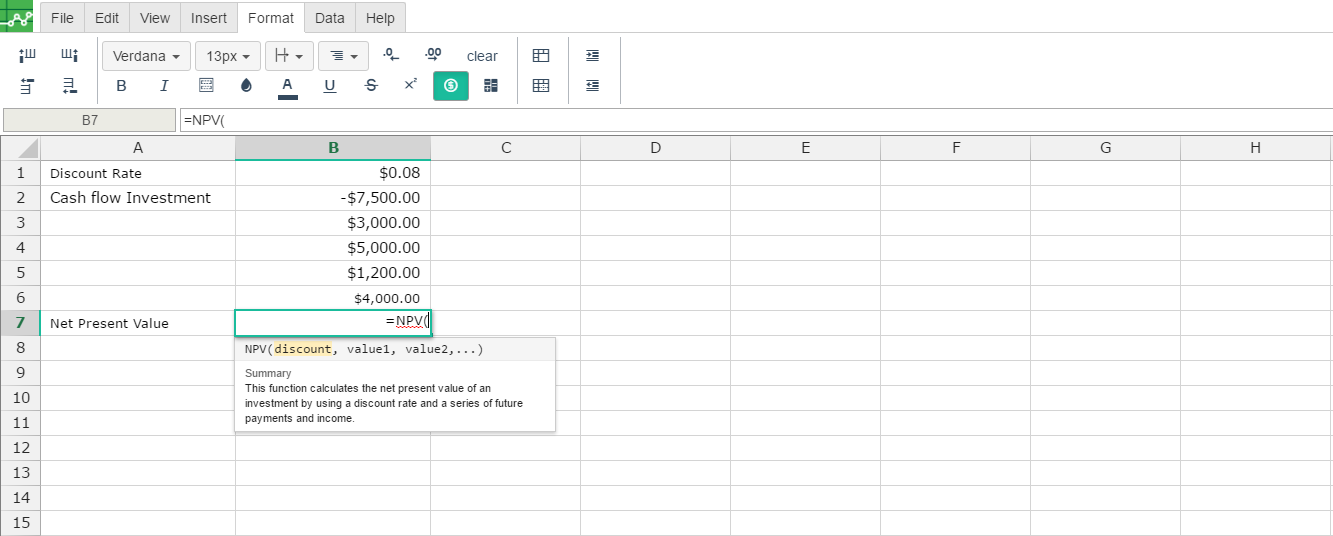

Step 2. Then type the NPV formula into the cell you have chosen to display the outcome:

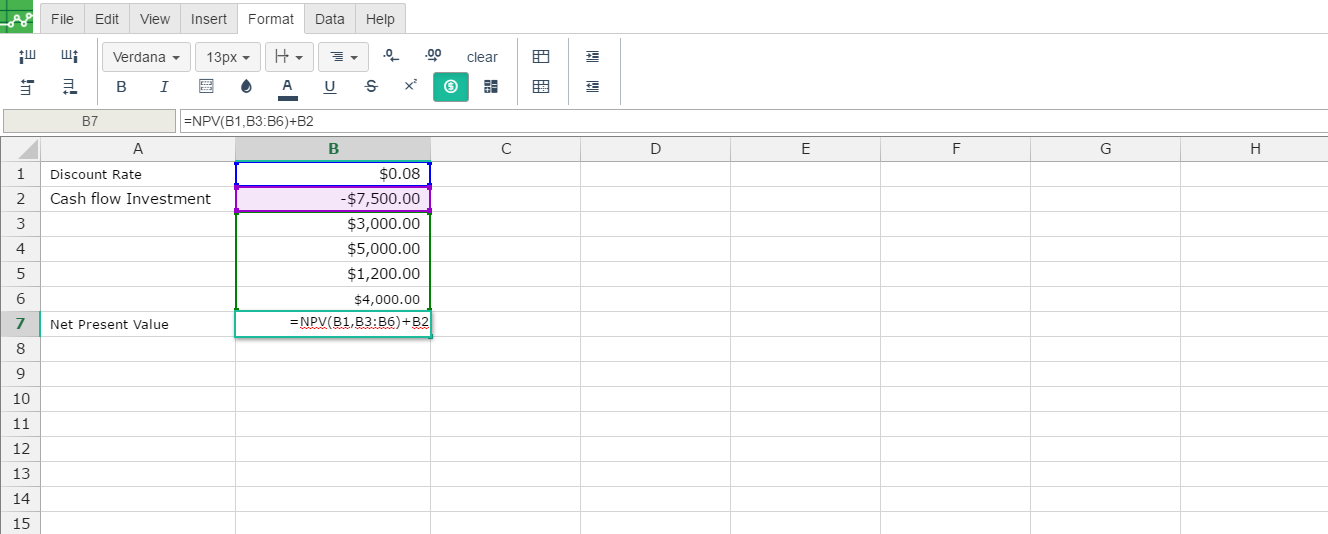

Step 3. Fill in the 4 values- In this example I have chosen 4 values that are the same.

Step 4. Once saved, your completed formula will display in a confluence page like this.

A

|

B

|

|

|---|---|---|

1

|

||

2

|

||

3

|

||

4

|

||

5

|

||

6

|

||

7

|